Driver misclassification a ‘disaster’ for trucking companies, TFI head says

Posted Feb 9, 2024 11:24:32 AM.

Last Updated Feb 9, 2024 04:24:08 PM.

MONTREAL — The head of Canada’s largest trucking firm says rampant undercutting of labour laws is harming companies like his as well as drivers, a problem felt all the more acutely in lean economic times.

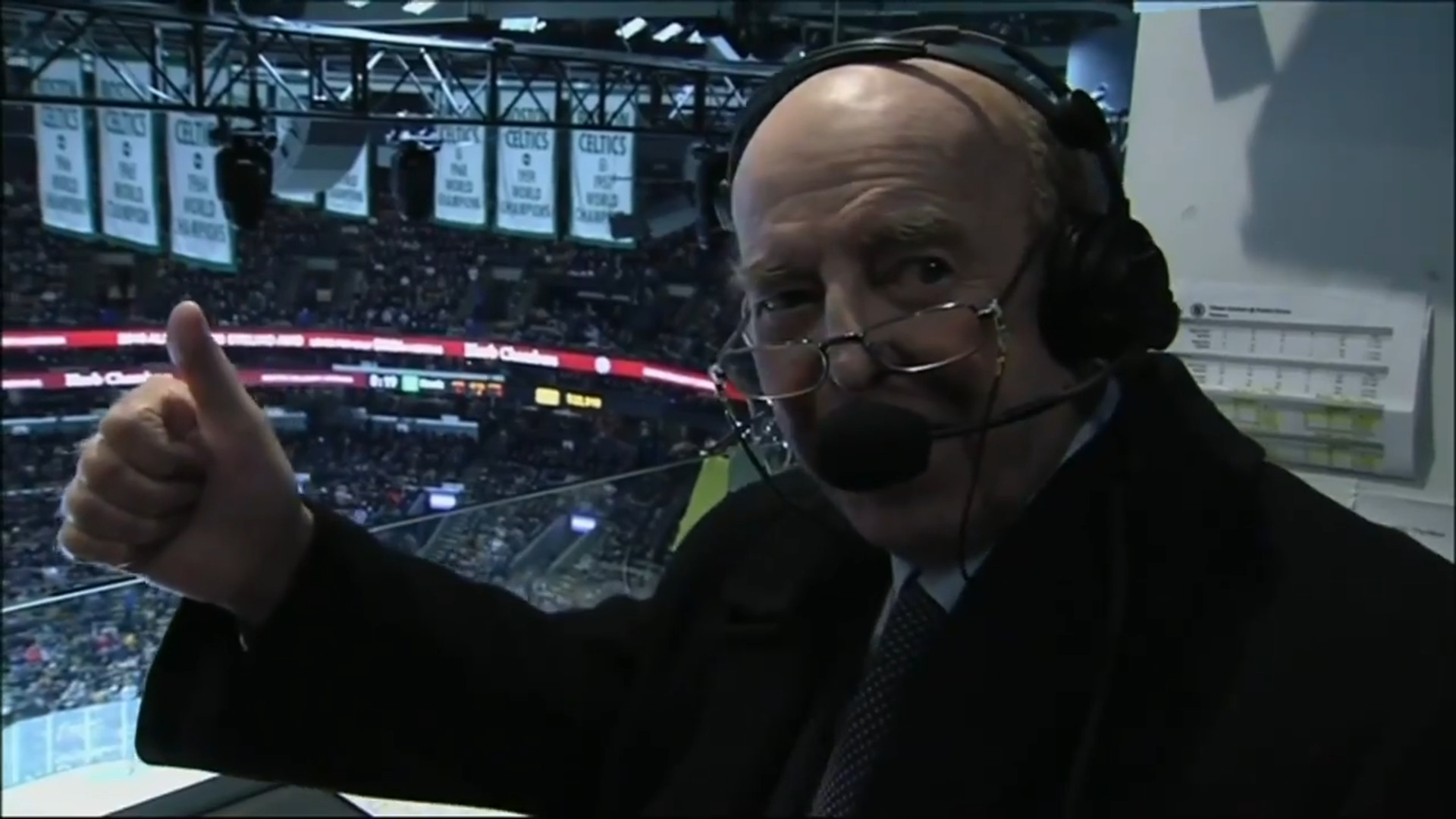

Alain Bédard, chairman and CEO of TFI International Inc., called the phenomenon known as Driver Inc. a “disaster” for legitimate truck outfits as rule-breaking rivals gain a competitive advantage.

“We are losing volume because the market is soft and we have unfair competition with the Driver Inc. situation,” he told analysts on a conference call Friday.

“This is a disaster that we have in Canada and nobody’s doing anything about it.”

Driver Inc. refers to the misclassification of workers as self-employed, which means the company does not provide benefits or basic labour protections.

The mislabelling of contractors who drive for only one company and do not own their trucks or control their own schedules is illegal — and risky, since workers do not receive basic entitlements such as workers’ compensation, paid sick leave, overtime or severance.

“They’re not paying any benefits to their drivers,” Bédard said.

While Ottawa has taken some steps toward tamping down the problem, truckers and owners alike want further action. They say the crisis continues to grow amid lagging enforcement, driving down profits and worker well-being in an industry already known for razor-thin margins and gruelling schedules.

Driver Inc.’s competitive edge may dull when demand ramps up again after a hard year. “But it will be a long-term problem for us as long as nobody in Ottawa or in Quebec or Toronto does anything about it,” he said.

Last year, the federal labour minister’s office said the government was focused on an “education-first approach to stop this discriminatory practice.”

“Employers who continue to knowingly break the law following education and awareness will be held accountable,” said Hartley Witten, press secretary to Labour Minister Seamus O’Regan, in an email last May.

Between January 2019 and March 2020, Ontario’s Workplace Safety and Insurance Board audited 204 trucking firms and found that 47 per cent of them under-reported driver earnings — something that can be a key indicator of misclassification.

Stephen Laskowski, president of the Canadian Trucking Alliance, applauded Employment and Social Development Canada for ramping up enforcement against violators in southern Ontario over the past couple of years.

“It’s a race to the bottom, and it’s also very much used to abuse people who are new to Canada,” he said of Driver Inc.

Laskowski has also called for harsher fines and even tougher crackdowns as a deterrent to misclassification.

Last year’s federal budget laid out funding to amend the Canada Labour Code to bolster job protections for federally regulated gig workers by strengthening bans on employee misclassification, said Canada Revenue Agency spokeswoman Hannah Wardell.

In the fall, the CRA launched the second phase of an educational campaign aimed at “personal services businesses.” The term denotes a special tax classification for contractors who “would be considered to be an employee of the payer” were they not incorporated — though federal labour law would see virtually no distinction: the benefits obligations do not change for the company writing the paycheque to the “contractor.”

“The information gathered by both of these pilot phases will help guide the CRA’s future education and compliance activities,” Wardell said in an email last year.

Relief can’t come soon enough for TFI and many other transport firms.

“It’s been terrible,” Bédard said of January, though mostly due to weather issues.

“For sure, Q1 is going to be a tough quarter for us.”

The Canadian trucking industry faces a shaky market as cargo volumes and rates continued to fall over the past year — in step with downward consumer demand — compared with the soaring highs seen during the pandemic.

On top of fewer shipments, costs have shot up while freight rates have plummeted.

At TFI, so-called less-than-truckload sales, which make multiple drops of cargo for different clients on a single run, fell by 16 per cent in its fourth quarter from the same period a year before. Revenue from full truckloads decreased even further, by 21 per cent. The two segments comprise more than 70 per cent of the company’s earnings.

TFI bolstered its fleet with the acquisition of Wisconsin-based JHT Holdings Inc. last year, which generates about US$500 million in annual revenue.

In December, it announced the purchase of Texas-based flatbed firm Daseke Inc. in a $1.1-billion deal expected to close in the second quarter.

On Thursday, TFI reported that net income fell 14 per cent year over year to US$131.4 million in the quarter ended Dec. 31. Revenue inched up by less than one per cent to US$1.97 billion. Nonetheless, the company beat earnings expectations, according to financial markets firm Refinitiv.

This report by The Canadian Press was first published Feb. 9, 2024.

Companies in this story: (TSX:TFII)

Christopher Reynolds, The Canadian Press