OPP warning residents of alarming rise in fraud in Ontario’s east region

Posted Aug 27, 2024 01:57:32 PM.

Last Updated Aug 27, 2024 02:45:05 PM.

Ontario Provincial Police (OPP) are warning residents about a rise in fraud cases across the National Capital Region.

This includes a resurgence of the “Grandparent Scam” in the North Grenville area, where fraudsters claim to be someone the individual knows — like a grandchild — telling the victim the money is urgently needed, police said.

“Overall, frauds are becoming more sophisticated and brazen, with fraudsters impersonating businesses, government agencies, law enforcement and law firms,” John Armit, OPP Acting Detective Sergeant Anti-Rackets Branch, told CityNews.

An older resident in Township of Edwardsburgh Cardinal received a call on Monday, with the caller claiming that a family member was seeking financial help after a collision — to ensure the car was fixed before police were made aware of the accident.

The scammer then offered to pick up the funds from the victim’s home, once they returned from the bank. But after speaking with a family member, the senior resident was able to confirm it was a scam before the money changed hands.

This is not the only concerning scam seen around the nation’s capital. Over the last several months police have warned of numerous frauds including a taxi and Uber scam, parking QR codes and the bank investigator fraud.

Incidents reported to the OPP often involve elderly victims and they will require supports in recovering from fraud, even when no financial losses occur, Armit added.

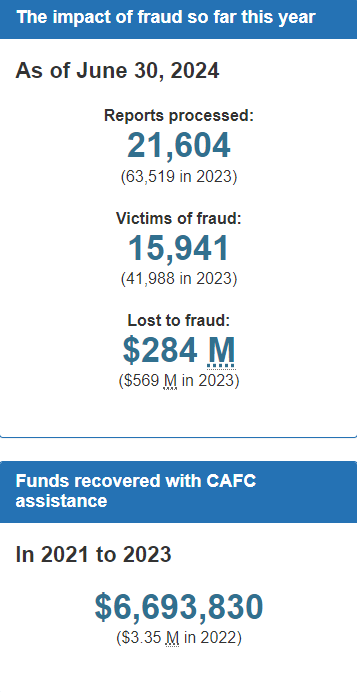

From Jan.1 to June 30, 2024, victims reported losing over $5.6 million to Bank Investigator fraud. The Canadian Anti-Fraud Centre (CAFC) reported that total losses were over $10.9 million in 2023.

Additionally, it is estimated that only five to 10 per cent of victims report frauds to the CAFC or law enforcement.

“OPP continues to receive reports from victims who have been contacted by fraudsters claiming to be bank investigators from their financial institution, local law enforcement or one of their online merchants,” wrote OPP in a post on X.

Often, scammers will ask for an individual’s help in an ongoing “investigation” against criminals who have compromised their bank accounts.

They will ask victims to deposit money or send funds overseas. It is not until the transfers are complete that victims realize their accounts had not been compromised in the first place. In efforts to make the call seem legitimate, some suspects will provide some of the victim’s personal information, including name, date of birth, phone number, address and/or debit card number.

Additionally, suspects often convince victims to send an e-transfer to their own cellphone number.

Fraudsters will provide instructions to add themselves as a payee, as well as, how to increase their daily e-transfer limited to $10,000, warned OPP. Scammers will then provide the e-transfer question and answer the victim will use for the transfer.

The victim will be instructed to send an e-transfer to their own cellphone number, and suspects will ask the victim for the last portion of the Interact e-transfer URL (link) received. Once fraudsters receive this information, they have the ability to deposit the funds into their own accounts.

Ottawa police recently put out a release saying fraudsters have found a way to impersonate their phone number and victim services.

“The Ottawa Police Fraud Unit typically receives about 30-35 fraud related complaints per day; and the most common are Marketplace, job and crypto type scams,” police told CityNews.

Ontario Provincial Police outline the warning signs of fraud and provide suggestions on how residents can protect themselves, including:

- Financial institutions or online merchants will never request residents to transfer funds to an external account.

- If a resident receives a call claiming to be from their financial institution, they should advise the caller that they will call them back. End the call and dial the number on the back of their bank or credit card from a different phone if possible or wait 10 minutes before making the outgoing call.

- Fraudsters use call-spoofing technology to mislead victims. Do not assume that phone numbers appearing on your call display are accurate.

- Residents should never provide remote access to their computer or smart phone.

“The best tool law enforcement has to tackle cyber enable frauds is through awareness and education,” said Armit.

OPP is asking that anyone who may have been a victim of fraud, to report the incident to local police service and to the CAFC at 1-888-495-8501 or online on the Fraud Reporting System (FRS).