Only six per cent of Canadians use cash at grocery stores: study

Posted Feb 3, 2023 05:00:00 PM.

A study from Dalhousie University published Thursday reveals only six per cent of Canadians still pay with cash exclusively.

In partnership with Angus Reid, the Halifax-based University’s nationwide study “Cashed Out: How a Cashless Economy Impacts Your Grocery Experience, a Canadian Perspective” saw over 1,500 Canadians surveyed in January.

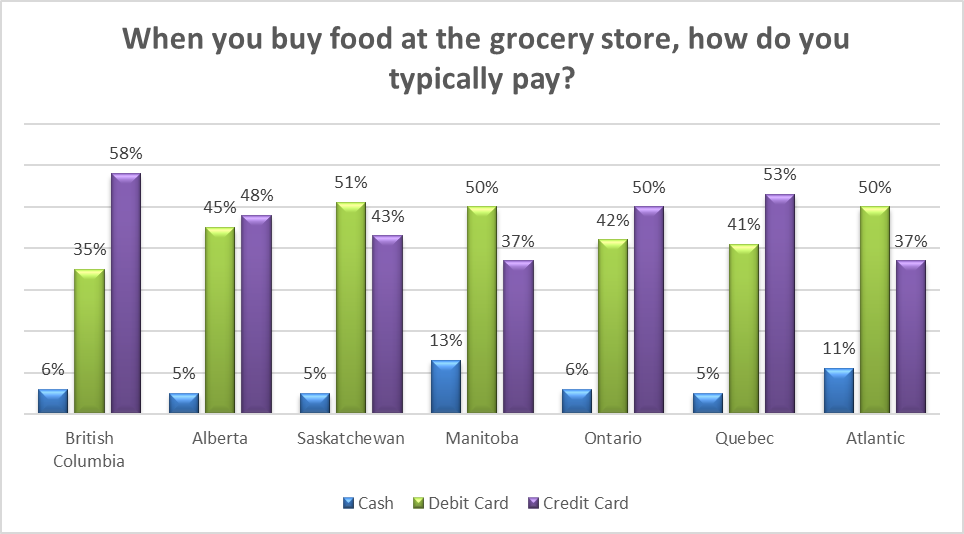

Of the groups that pay with cash at grocery stores, Manitoba has the highest percentage at 13 per cent, whilst Alberta is among the least with five per cent alongside Québec and Saskatchewan.

Credit cards are the most popular payment method in British Columbia, at 58 per cent, whereas Manitoba and the Atlantic provinces are the lowest, at 37 per cent.

However, when it comes to Canadians using cash, the report notes a paradox.

Only 27 per cent of Canadians believe using cash is outdated, while 74 per cent of Canadians believe using cash is inconvenient. Only 26 per cent of Canadians believe grocery stores won’t accept cash within five years.

The report also shows that there is a concern for a cashless grocery system, as it may lead to a future that would leave out the marginalized without banking access.

Sixty per cent of Canadians believe cash is important since it is the only way to support some charities collecting donations at grocery stores.

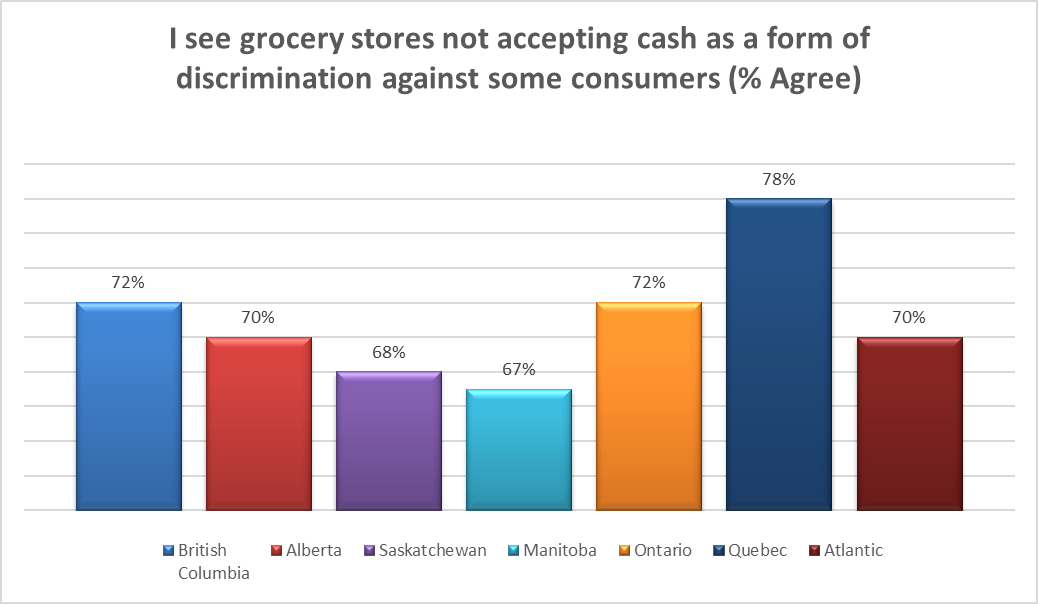

In addition, Canadians feel strongly about a cashless grocery store when talking about discrimination. A total of 73 per cent believe a cashless grocery store can be discriminatory, with Québec having the highest percentage.

However, economists, like Concordia University Professor Moshe Lander, argue that card payments are not only convenient but also cost-effective.

“Any store these days will pretty much accept debit and credit technology, and the cost has come down enough that from their standpoint, it’s more efficient. They don’t have to deal with Brink’s trucks coming in, dropping off cash, picking it up, moving it to bank accounts … it’s a much smoother system,” Lander said.

“I think that other than maybe a few underbanked, unbanked, and maybe senior citizens that are still a little bit skeptical about debit and credit technology, we’re not far away from being done with cash for good.”

According to the Financial Consumer Agency of Canada (FCAC), in 2022 an estimated 6 per cent of Canadian households, or 1.5 million homes, were unbanked, meaning they had no account at a financial institution.

The FCAC also estimated around 15 per cent of Canadian households were considered underbanked, meaning they had an account at a financial institution but still used alternative financial services such as payday loans or cheque-cashing services.

Factors that contribute to being unbanked or underbanked include low income, lack of education, and immigration status.

CityNews spoke with some Calgarians on how they feel about cashless grocery stores.

“There are so many people who deal with cash and especially seniors because they are not tech savvy like us,” said Nikhil Sachdeva.

“There are certain minorities that benefit from using cash, such as the homeless and elderly. I think they should be supported with using cash in grocery stores,” said fellow Calgarian Amanda Wine.

The survey also reports that more than half of Canadians consider a cashless economy to be a threat to their own privacy.

But Lander disagrees.

He says digital transactions and information collection are not new phenomena to be afraid of.

“Grocery stores are monitoring you every time you use your grocery store club card, like Safeway card or Save On Foods card. You don’t have to use a credit card. Even if you pay in cash, they’re still monitoring your purchases,” said Lander.

“They are still catering the promotions and the specials that they offer you, based on what you purchase, not which card you use or whether you use cash, he added.”